#1 GDP

growth will remain solid at around 3%

We project real GDP to grow 2.8% in 2022

Looking at the

trajectory of GDP, Taiwan will remain the outperformer among the four Asian

Tigers in 2022.

Setting the aggregate output in 2019 at 100, it shows that Taiwan will end 2022

about 12% above the pre-pandemic output level. In contrast, Hong Kong SAR,

Singapore and South Korea will only be 2-6% higher than the levels of three

years ago.

#2

Semiconductor sector a bright spot

In Taiwan, the major

foundries including TSMC, UMC, Powerchip and VIS have all indicated more than

10% hike in their chip prices next year. TSMC has confirmed the plan to build a

new chip plant in Kaohsiung in 2022 to expand the capacity of 7nm and 28nm

production. The company also aims to enter the mass production of 3nm chips in

2H22. Capital spending in the semiconductor sector is expected to continue to

bolster Taiwan’s investment growth next year.

#3

Property market will remain buoyant

The current round of

property market rally in Taiwan, which started in 2H20, could be largely

attributed to the abundant liquidity and low interest rates environment after

the pandemic. Going forward, interest costs are set to rise in 2022, in the

context of monetary policy normalisation by global major central banks. On the

other hand, unemployment rate is likely to continue to decline and wage growth

is likely to pick up, which should help to lend some fundamental support to the

property sector.

Aggressive policy

tightening appears unlikely. The central bank has adopted selective credit

control measures since end-2020, lowering the loan-to-value ratio for

third/fourth home purchases and high-price properties. The government amended

the integrated house and land transaction income tax, raising the tax rates on

the sales of properties within five years of purchases. These measures were

introduced in a progressive and transparent manner, indicating policymakers’

intention to discourage the speculative activities and engineer a soft landing

in the property market. Admittedly, the risk of government policy intervention

could rise in the later part of 2022, when the year-end local elections draw

close.

#4

Companies will seek to further diversify their supply chains

On the corporate

front, a new wave of outward investment appears underway. The China-US trade

war, which broke out in 2018, has prompted Taiwanese manufacturers to move

their production from the mainland back to Taiwan in the last few years. More recently, the Covid pandemic urges

manufacturers to further diversify their supply chain network on a global

basis, increasing the ratio of local production for local consumption in the

major markets. Meanwhile, the rise in cross-strait tensions also plays as a

catalyst for Taiwanese manufacturers to build the offshore production bases, to

hedge the risk of supply chain disruptions during the unexpected future shocks.

#5

Consumers’ purchasing power will improve

CPI inflation, on the other hand, is projected to ease to 1.3% next year from 1.9% this year (Brent oil assumption: USD75-80/barrel on average). In response to the recent surge in global energy prices, the state-owned Chinese Petroleum Corporation has activated the price stabilisation mechanism to cap the adjustments in retail fuel prices, and the Taiwan Power Company has frozen electricity tariffs. There is adequate leeway for the government to stabilise the important livelihood prices via fiscal measures, thanks to the sound fiscal position and low public debt burdens.

#6

Government is in no hurry to end the Covid-zero strategy

First, the percentage

of fully vaccinated people in Taiwan has remained lower than the 80% mark, at

60% as of early-December. As the process of mass vaccination spreads over a

relatively long time of period, the risk of vaccine efficacy decline cannot be

neglected. Second, global virus situation remains fluid, given the emergence of

the new Omicron variant and the resurgence of infections in Europe. Third, the

outlook for domestic Covid policies will also be complicated by the local

elections next year.

#7 The

central bank may start to normalise monetary policy

#8 CPTPP

and trade issues will receive greater public attention

To maintain the

long-term trade competitiveness, Taiwan has submitted the application to join

the Comprehensive and Progressive Agreement for Trans-Pacific Partnership this

year. It has also resumed the Trade and Investment Framework Agreement talks

with the US. Note that the Regional Comprehensive Economic Partnership, a

multilateral free trade agreement that excludes Taiwan currently, will take

effect in January 2022. The pressure for Taiwan to accelerate the CPTPP

entrance will likely increase next year.

Following Taiwan’s

application, the CPTPP Commission will decide whether to commence the accession

process and set up an accession working group. If the working group is formed,

Taiwan will need to submit its offer for terms of market access within 30 days.

Given that many CPTPP members are large exporters of agricultural goods, Taiwan

may need to review its current policies on agricultural trade, such as the bans

on food imports from Fukushima of Japan. This could cause broad debates and

draw the public’s attention, against the backdrop of local elections next year.

The government’s move of easing US beef and pork imports has caused public

concerns this year, triggering a referendum on the imports of pork containing

the growth and leanness agent ractopamine.

#9 Green

investment will continue to gain momentum

#10

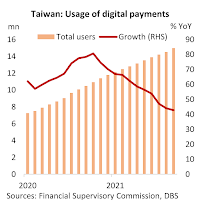

Digitalization demand to remain strong

According to official

estimate, the overall size of Taiwan’s digital economy reached a record

TWD4.9tn in 2020 (25% of GDP), including TWD2.1tn of software services (11% of

GDP). The government targets at boosting the size of digital economy and that

of software services to TWD6.5tn and TWD2.9tn respectively by 2025 (30%, 13% of

GDP). Both targets should be easily achievable, taking into account the

acceleration trend after Covid. We expect the total size of Taiwan’s digital

economy to reach the TWD7tn mark by 2025.